Idris Elba’s Akuna wallet launches in Ghana through a government partnership with the Stellar Development Foundation, marking a watershed moment for Africa’s creator economy, addressing the fundamental payment infrastructure gap preventing millions of content creators from accessing the $470 billion global creative marketplace, despite Africa representing 18% of the world’s population yet capturing less than 1% of creative economy revenues. This blockchain-powered digital wallet, operating under Bank of Ghana regulatory supervision, provides Ghanaian creators with virtual US bank accounts, enabling direct international payments within seconds and eliminating the reliance on intermediaries that have historically excluded African creators from monetizing content on platforms like TikTok, YouTube, and Instagram.

This comprehensive analysis examines the technical architecture, regulatory framework, market opportunity, and strategic implications of Akuna Wallet‘s pilot launch, revealing how this initiative could establish the blueprint for solving Africa’s creator payment crisis while positioning Ghana as a regional fintech innovation hub.

The $18 Billion Payment Barrier: Why African Creators Can’t Get Paid

The stark reality confronting African content creators exposes systemic financial infrastructure failures preventing participation in the global digital economy. Despite producing viral content that has been consumed by millions of views across social platforms, African creators face insurmountable barriers in converting digital engagement into sustainable income through mechanisms available to creators in developed markets.

The Unbanked Youth Crisis Creating Opportunity Cost

Ghana exemplifies the continental challenge where nearly 60% of the population under age 25 remains unbanked, lacking access to traditional banking services required for international payment receipt. This demographic reality creates paradoxical exclusion where the continent’s youngest, most digitally-native generation, producing content consuming global audiences, cannot monetize their creativity due to banking infrastructure deficits inherited from colonial-era financial systems never designed for digital economy participation.

The opportunity cost compounds when examining global creator economy projections. Goldman Sachs forecasts the creator economy expanding from $240 billion in 2024 to $470 billion by 2027, representing a near-doubling within three years. Africa’s projected creator economy reaching $18 billion by 2030 constitutes substantial growth yet still represents less than 4% of the global total despite demographic weight suggesting a proportional share should exceed 18%.

Current data shows 385 million active social media users across Africa engaging on platforms including TikTok, Instagram, and YouTube, yet most cannot convert engagement into sustainable income due to payment infrastructure gaps. Ghanaian DJ and producer Vyrusky articulates the practical challenge: “You have the executive producer in London trying to send money to start a promotion in Ghana. You need someone in Ghana who has that amount sitting in accounts, and before you start, you’re maybe a week or two weeks behind”.

Platform Monetization Requirements Excluding African Banks

Popular global content platforms that enable creator monetization universally require international bank accounts linked to payment systems that the African banking infrastructure cannot access. TikTok Creator Fund, YouTube Partner Program, Meta’s monetization tools, Patreon, and similar platforms processing billions in creator payments annually explicitly exclude banks from most African countries, including Ghana, from their approved financial institution lists.

This systematic exclusion forces African creators into expensive workarounds, consuming 20-30% of potential earnings through intermediary services like PayPal, Western Union, or cryptocurrency exchanges, requiring multiple conversion steps, lengthy settlement periods, and prohibitive fee structures. Alternative paths, including international friends serving as payment receivers or informal money transfer networks, create dependency, delay, and risk, fundamentally undermining creator economy participation.

The technical barrier stems from correspondent banking relationships where African banks lack direct connections to global payment rails, including SWIFT networks, ACH systems, and card payment processors, enabling instant cross-border settlements standard in developed markets. Building these relationships requires capital reserves, regulatory compliance, and operational infrastructure. African financial institutions, particularly smaller banks and mobile money operators, cannot economically justify individual creator payment flows.

The Cross-Border Friction Multiplier

Beyond initial payment receipt challenges, African creators face compounding friction when managing international collaborations, receiving royalties, or processing marketplace transactions fundamental to creative economy participation. Music producers collaborating with international artists encounter week-long delays awaiting payment clearance before commencing work. Visual artists selling through global marketplaces forfeit 30-40% of sale proceeds to payment intermediaries and currency conversion. Content creators building international audiences cannot accept sponsorship payments from brands operating outside Africa.

Currency volatility compounds friction where local currency depreciation against dollar-denominated payments erodes earnings between transaction initiation and final receipt. Ghanaian cedi volatility, naira instability, and similar currency challenges across African markets create unpredictability, preventing creators from accurate financial planning or sustainable business development. Traditional solutions, including maintaining offshore accounts, require minimum balances and documentation that African creators cannot provide, completing the exclusion cycle.

The infrastructure gap extends beyond payment mechanics to rights management, royalty distribution, and intellectual property monetization, requiring transparent, auditable transaction records that African payment systems cannot provide. Blockchain technology specifically addresses this limitation through immutable transaction records, programmable smart contracts, and decentralized settlement, eliminating intermediary manipulation capabilities central to Akuna Wallet’s value proposition.

Akuna Wallet Technical Architecture: The Three-Layer Solution

Akuna Wallet’s technical implementation combines blockchain settlement infrastructure, regulatory compliance frameworks, and user experience design, creating the first African-specific solution addressing creator payment challenges comprehensively rather than applying developed-market templates ill-suited to local contexts.

Layer 1: Stellar Blockchain Settlement Infrastructure

Stellar blockchain serves as Akuna Wallet’s technical foundation, enabling instant, low-cost cross-border payments through a decentralized network architecture processing transactions in 3-5 seconds at costs below $0.01 per transaction. Unlike traditional banking infrastructure requiring correspondent relationships, clearinghouse intermediation, and multi-day settlement cycles, Stellar facilitates direct peer-to-peer value transfer between parties regardless of geographic location or banking relationships.

The Stellar network’s design specifically optimizes for financial inclusion use cases through features including built-in currency exchange enabling seamless conversion between assets, account creation requiring minimal blockchain knowledge, and operation through lightweight mobile applications suitable for African connectivity constraints. These characteristics differentiate Stellar from cryptocurrency platforms like Bitcoin or Ethereum, emphasizing investment speculation over payment utility, making it suitable for regulated financial services Bank of Ghana demands for sandbox participation.

Stellar Development Foundation (SDF), the nonprofit organization maintaining the Stellar network, provides technical support, regulatory guidance, and ecosystem development resources essential for Akuna Wallet’s implementation. SDF CEO Denelle Dixon’s direct engagement with Ghana’s Minister of Communication, Digital Technology, and Innovations, Samuel Nartey George, signals institutional commitment extending beyond technology provision to partnership in regulatory navigation and market development.

The blockchain settlement layer enables Akuna Wallet’s core functionality, including instant international payment receipt, stable coin holdings protecting against local currency volatility, peer-to-peer transfers between creators without fees, and programmable payment conditions enabling rights management and royalty distribution. These capabilities operate within the regulatory framework Bank of Ghana establishes, rather than circumventing financial oversight as decentralized cryptocurrency platforms attempt a critical distinction, enabling government partnership.

Layer 2: Virtual US Bank Account Bridge

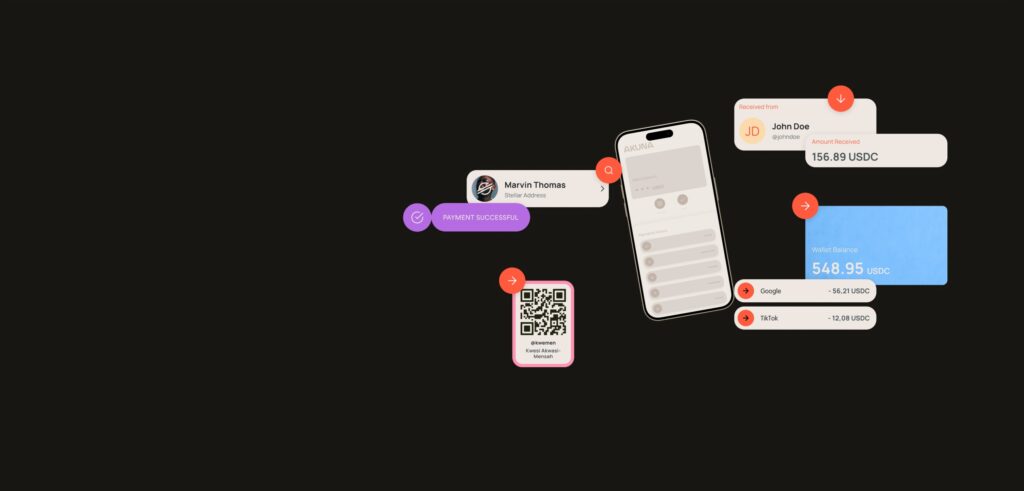

Akuna Wallet provides users with virtual United States bank accounts connected to global payment systems, creating the critical bridge between international platforms requiring US banking relationships and African users traditionally excluded from accessing such accounts. This innovation directly addresses platform monetization barriers where TikTok, YouTube, Meta, and similar services mandate US or European bank accounts for creator payment processing.

The virtual account mechanism operates through partnerships with US-licensed financial institutions, providing Account and Routing numbers that Akuna Wallet users can register on content platforms exactly as US-based creators would. When platforms process payments to these accounts, funds settle in the Stellar blockchain wallet within seconds rather than traditional 3-5 business day ACH processing, immediately available for conversion to Ghana cedis or other currencies.

Users maintain control through a non-custodial wallet design where Akuna Group cannot access or freeze user funds without user authorization, a critical security feature differentiating from custodial services like PayPal, where the company maintains complete funds control. This design aligns with financial sovereignty principles important to Idris Elba’s vision of empowering rather than intermediating African creators.

The virtual account layer integrates invoicing tools, enabling freelancers to bill international clients professionally with payment directly to their Akuna Wallet accounts. Designers, developers, consultants, and other service providers can issue invoices denominated in dollars while receiving instant cedi-converted payments, eliminating the week-long delays Vyrusky describes in traditional cross-border payment workflows.

Layer 3: Bank of Ghana Regulatory Integration

Bank of Ghana’s Regulatory and Innovation Sandbox provides the essential third layer, enabling Akuna Wallet’s legal operation through a controlled testing environment, allowing blockchain innovation under central bank supervision. This framework, launched in partnership with EMTECH Solutions and FSD Africa, creates a supportive policy environment for financial service providers testing innovative products, services, or business models in live environments while demonstrating regulatory compliance.

The sandbox participation process requires applicants to demonstrate innovations addressing financial inclusion challenges, submit to ongoing regulatory oversight, and operate within defined testing parameters typically spanning six months with possible three-month extensions. Bank of Ghana explicitly prioritizes blockchain technology applications, remittance products, and solutions targeting women’s financial inclusion categories that Akuna Wallet directly addresses.

Sandbox admission during the pilot phase signals the Bank of Ghana’s progressive approach, where the central bank became among Africa’s first to accept blockchain solutions for regulatory testing. This decision reflects institutional recognition that financial technology evolution requires adaptive regulation rather than prohibition, creating a competitive advantage for Ghana relative to African countries that maintain restrictive approaches to fintech innovation.

The regulatory integration extends beyond sandbox participation to a Memorandum of Understanding between Akuna Group, Stellar Development Foundation, and Bank of Ghana, establishing a collaboration framework for pilot testing with local content creators. Minister George’s affirmation of the Ministry’s readiness to support testing demonstrates the government’s commitment to creative economy digitization as a national priority rather than an experimental side project.

Full commercial launch expected December 2025, following regulatory clearance, will transition Akuna Wallet from a limited pilot cohort to general availability for Ghanaian creators, subject to the Bank of Ghana’s assessment of pilot performance, including transaction security, currency conversion efficiency, regulatory compliance, and user adoption rates. Success in establishing a pathway for expansion to other African markets, where similar creator payment challenges persist, but regulatory frameworks may require different approaches.

Idris Elba’s Vision: From Hollywood to Africa’s Entertainment Infrastructure

Idris Elba’s involvement in Akuna Wallet transcends celebrity endorsement to represent a decade-long commitment to building Africa’s entertainment infrastructure, addressing systemic barriers preventing the continent from capturing a proportional share of the global creative economy. This vision began crystallizing during the 2024 World Economic Forum in Davos, where Elba met Tanzanian President Samia Suluhu Hassan, leading to the announcement of Africa’s first modern film studio construction in Zanzibar.

Personal Connection to Ghana Driving Market Selection

Ghana’s selection as Akuna Wallet’s first pilot location reflects both regulatory readiness and personal connection, where Elba’s mother is Ghanaian, making the country a natural starting point for initiatives aimed at empowering African creators. This family connection provides cultural understanding and authentic commitment, differentiating from extractive business models where international investors seek profit from African markets without reciprocal value creation or community integration.

Elba’s public advocacy consistently emphasizes African creative potential, currently undervalued through systemic barriers rather than talent deficits. At SXSW London 2025, Elba articulated the core challenge:

“There is a vibrant, dynamic creative community in Africa that’s too often overlooked. The Akuna Wallet empowers African storytellers to engage in the global creative economy, giving them the tools to succeed”.

This framing positions payment infrastructure as enabling technology rather than a financial service, recognizing that creative expression exists abundantly but monetization pathways remain blocked.

The broader Akuna Group ecosystem extends beyond wallet functionality to encompass Akuna Studios for content production, Akuna Pods for creator collaboration spaces, and the Akuna Cinema chain, aspiring to establish “the African Odeon” addressing exhibition infrastructure gaps where the entire continent maintains fewer than 3,000 cinema screens serving a population exceeding 1.3 billion. This comprehensive approach tackles multiple constraints simultaneously rather than addressing single pain points in isolation.

Strategic Partnership with Stellar Development Foundation

Stellar Development Foundation’s selection as Akuna Wallet’s blockchain infrastructure provider reflects strategic alignment around the financial inclusion mission and technical capabilities suited to African market requirements. SDF’s nonprofit structure and explicit focus on enabling financial access for underserved populations distinguish it from profit-maximizing cryptocurrency platforms or blockchain protocols optimized for decentralized finance speculation.

Denelle Dixon’s direct engagement in Ghana meetings, policy discussions, and technical implementation signals institutional commitment extending beyond technology licensing to active partnership in market development. This hands-on involvement provides Akuna Group access to Stellar’s decade of experience building financial infrastructure in emerging markets, regulatory navigation expertise, and technical resources, accelerating development timelines relative to building proprietary blockchain solutions.

The partnership model establishes a template potentially replicable across African markets where Stellar provides proven blockchain infrastructure while local partners, including celebrity advocates, government agencies, and financial regulators, customize implementation to local contexts. This approach balances standardization benefits, including interoperability and security, with localization requirements, including regulatory compliance and cultural adaptation.

Manon Dave: The Design Architect Behind Brand Identity

Manon Dave’s role in building Akuna Wallet’s brand identity and designing the application represents a crucial yet underreported contribution to the initiative’s user experience and market positioning. Dave’s design philosophy prioritizes accessibility, removing complexity barriers preventing technology adoption among creators focused on content production rather than financial technology understanding.

The application interface emphasizes simplicity through intuitive navigation, visual clarity in transaction flows, and educational content explaining blockchain concepts without requiring technical expertise. This design approach differentiates from cryptocurrency wallets, assuming user technical literacy or traditional banking applications reflecting institutional rather than user perspectives.

Brand positioning around “transform imagination into income” captures aspirational messaging resonating with creative professionals while avoiding technical jargon or blockchain evangelism, potentially alienating target users skeptical of cryptocurrency volatility and scams prevalent in African markets. This positioning frames Akuna Wallet as a creative tool rather than a financial product, aligning with how target users conceptualize their needs.

Market Opportunity Analysis: The $18 Billion African Creator Economy

Comprehensive market analysis reveals Akuna Wallet addresses an opportunity measured not in millions but billions of dollars as Africa’s creator economy expands from its current sub-1% global share toward proportional representation matching demographic weight. Understanding this opportunity requires examining current creative sector contributions, growth projections, and multiplier effects from improved payment infrastructure.

Current Creative Sector Economic Impact

Ghana’s creative sector currently contributes approximately 2.5% to national GDP, translating to roughly $2 billion annually based on $80 billion GDP. However, this measurement captures only formal creative industries, excluding the vast informal creative economy where most creators operate outside regulatory frameworks and statistical collection mechanisms.

UNESCO’s 2010 cultural report finding Ghana’s cultural activities accounting for 1.53% of GDP, with acknowledgment that true contribution significantly exceeds measurement when including informal economy, suggests official statistics drastically undercount creative sector impact. Sector participants, informal employment, and indirect economic activity, including tourism, attracted by creative content, likely double or triple the measured contributions.

Youth participation data reveals passion and self-expression as primary motivations for creative sector involvement, with 50% of surveyed participants citing passion, 30% identifying self-expression desire, and only 15% motivated primarily by financial reward. This motivational structure suggests enormous latent creative energy currently undermonetized due to infrastructure barriers rather than a lack of commercial ambition.

Financial constraints, limited mentorship, societal stigma, and lack of support emerge as primary barriers impeding youth creative participation, with 60% of participants identifying personal connections and networks as crucial for success. Only 45% express confidence in their abilities and skills, while 20% report supportive families, highlighting social capital and institutional support gaps that Akuna Wallet’s ecosystem approach partially addresses.

Growth Projections and Multiplicative Effects

UNESCO projects Africa’s film and audiovisual industry alone could generate 20 million jobs and contribute $20 billion to continental GDP by 2030, representing a 10x increase from the current estimated $2 billion sector size. These projections assume infrastructure investments, including production facilities, distribution networks, and critically, payment systems enabling creators to capture fair value from their work.

Goldman Sachs forecasts the global creative economy doubling from $240 billion in 2024 to $470-530 billion by 2027-2030, creating an unprecedented opportunity window for African creators if payment barriers dissolve. Africa’s projected capture of $18 billion by 2030 represents substantial absolute growth yet still constitutes less than 4% of the global total, suggesting further growth potential if infrastructure parity with developed markets emerges.

South Korea’s entertainment sector export growth, averaging 13% annually from 2017-2021, outpacing overall export growth by 2.5x and adding $27 billion to the national economy, provides a comparable case study of creative sector economic impact when supported by appropriate infrastructure and government policy. Korean Wave success demonstrates cultural exports generating economic value beyond direct creative sector revenues through tourism, brand elevation, and soft power.

Nigeria’s creative economy, contributing 2.3% to GDP through Nollywood, Afrobeats, and related industries despite similar infrastructure challenges facing Ghana, suggests room for growth when payment barriers dissolve and production quality improves. South Africa’s 3% creative sector GDP contribution, supported by formal institutions and policy frameworks, demonstrates the achievement possible with sustained investment and regulatory support.

Platform Monetization Unlock Calculating Real Value

Current platform monetization rates provide a framework for calculating Akuna Wallet’s potential impact. YouTube Creator Fund distributes approximately $0.003-0.005 per view to eligible creators, translating to $3,000-5,000 per million views. Ghana’s 385 million active social media users, generating billions of annual video views currently cannot monetize this engagement due to payment barriers.

TikTok Creator Fund offers $0.02-0.04 per 1,000 views, suggesting creators generating 10 million monthly views could earn $200-400 monthly, a substantial income in Ghana, where the median monthly income approximates $200-300. Instagram Reels bonuses, Facebook Stars, and similar monetization programs offer comparable earning potential currently inaccessible to Ghanaian creators lacking international banking relationships.

Freelance creative services, including graphic design, video editing, social media management, and content writing, command global rates $20-100 hourly when accessed through international platforms like Upwork, Fiverr, and Toptal. Ghanaian creatives with competitive skills cannot fully participate in these marketplaces due to payment receipt challenges, forcing them to accept below-market rates through informal channels or abandon opportunities entirely.

Multiplicative effects from enabling even 10% of Ghana’s under-25 population to monetize creative skills at median global freelance rates ($30 hourly, 20 hours monthly) would generate $150 million monthly or $1.8 billion annually, nearly doubling Ghana’s measured creative economy contribution. This calculation excludes secondary effects, including platform fees paid to Ghanaian payment processors, equipment purchases from local retailers, and tax revenues from formalized creative economy activity.

Regulatory Innovation: Bank of Ghana’s Fintech Sandbox Success

Bank of Ghana’s Regulatory and Innovation Sandbox represents a critical enabler for Akuna Wallet’s development, providing a structured framework for testing blockchain financial services under central bank supervision while maintaining financial stability and consumer protection. Understanding this regulatory innovation reveals how progressive policy creates a competitive advantage in attracting fintech investment and talent.

Sandbox Framework Design and Admission Process

The sandbox framework establishes a controlled testing environment enabling financial service providers to pilot innovative products with real customers under regulatory supervision without full licensing requirements that would make early-stage testing economically infeasible. Participants operate under special exemptions, allowances, or limited exceptions for defined testing periods, typically six months, with possible three-month extensions, allowing regulators to assess innovation viability, safety, and market fit before permanent regulatory integration.

Eligibility extends to both licensed financial institutions, including banks, specialized deposit-taking institutions, and payment service providers, and unlicensed fintech startups meeting sandbox requirements, a critical inclusion enabling innovation from actors outside the traditional financial sector. Priority areas for first cohort admissions included blockchain technology applications, remittance products, crowdfunding solutions, and electronic Know Your Customer platforms, with subsequent cohorts expanding to regulatory technology, supervisory technology, and digital banking innovations.

Foreign companies cannot directly apply but may participate through a Ghanaian subsidiary with a minimum 30% local equity participation, balancing innovation access with economic nationalism, ensuring Ghanaian stakeholders capture value from fintech development. This requirement incentivizes partnership models like the Akuna Group-Stellar arrangement rather than pure foreign direct investment, extracting profits without local capacity building.

Bank of Ghana’s bold decision to adopt a blockchain solution during the pilot phase, becoming among Africa’s first central banks to formally accept blockchain technology for regulatory testing, signals institutional sophistication, recognizing technology’s potential for financial inclusion despite risks requiring management. This progressive stance contrasts with African countries maintaining blanket cryptocurrency prohibitions or restrictive approaches that stifling innovation.

Regulatory Oversight and Performance Monitoring

Sandbox participants submit to ongoing regulatory supervision, including regular reporting requirements, transaction monitoring, and consumer complaint tracking, ensuring innovations maintain financial stability, protect consumers, and comply with anti-money laundering and counter-terrorism financing obligations. This oversight balances innovation encouragement with prudential regulation, allowing experimentation within guardrails rather than complete deregulation.

Bank of Ghana monitors key performance indicators, including transaction security, system reliability, customer complaint resolution, regulatory compliance adherence, and broader financial inclusion impact. Sandbox participants failing to meet performance standards or creating unacceptable risks face suspension or termination, with successful innovations transitioning to permanent licensing frameworks enabling full market launch.

The Memorandum of Understanding between Bank of Ghana, Akuna Group, and Stellar Development Foundation formalizes regulatory oversight arrangements specifically for the Akuna Wallet pilot, establishing reporting requirements, compliance standards, and performance benchmarks guiding pilot assessment. Minister George’s commitment to monitoring pilot performance closely before recommending broader digital payment ecosystem integration signals the government is treating this as a serious policy initiative rather than an experimental side project.

Stakeholder assessments will examine transaction security, ensuring blockchain infrastructure prevents fraud and protects user funds, currency conversion efficiency, evaluating cedi settlement speed and exchange rate fairness, regulatory compliance, verifying adherence to financial regulations and consumer protection standards, and user adoption rates, measuring target demographic engagement and platform stickiness.

Policy Implications and Regional Leadership

Ghana’s regulatory innovation positions the country as a potential regional fintech hub, attracting investment, talent, and partnership opportunities from global technology companies seeking African market access through jurisdictions with clear regulatory frameworks. This competitive positioning generates economic benefits extending beyond direct fintech sector employment to include professional services, technology infrastructure, and knowledge economy development.

The fintech license passporting initiative implemented in collaboration with the National Bank of Rwanda promotes cross-border fintech innovation, enabling companies licensed in one jurisdiction to operate in partner countries with streamlined approval, reducing regulatory burden, and enabling regional scale. This framework could enable Akuna Wallet’s expansion from Ghana to Rwanda and potentially additional African countries negotiating similar arrangements.

Digital transformation initiatives, including eCedi central bank digital currency pilot, digital credit directive enabling responsible digital lending, and virtual assets bill establishing a cryptocurrency regulatory framework, demonstrate a comprehensive approach to financial sector modernization rather than piecemeal policies. This holistic strategy creates policy certainty, attracting long-term investment compared to jurisdictions with volatile or unclear regulatory approaches.

Success in establishing a blueprint potentially replicable across African countries facing similar creative economy payment challenges, but lacking regulatory frameworks enabling blockchain financial services innovation. Akuna Wallet’s pilot results will be closely watched by policymakers continent-wide, evaluating whether to embrace similar approaches or maintain conservative positions on blockchain technology.

Implementation Roadmap: From Pilot to Continental Scale

Akuna Wallet’s phased implementation strategy balances rapid market validation with sustainable growth, beginning with a Ghana pilot before expanding to additional African markets where creator payment challenges persist but regulatory and market contexts require customization. Understanding this roadmap reveals strategic decisions shaping the initiative’s probability of achieving continental impact versus remaining a niche solution.

Phase 1: Ghana Pilot and Product-Market Fit (2024-2025)

Initial pilot launched in October 2024 focused on a limited user cohort onboarding Ghanaian creators through waitlist at akunawallet.com, enabling controlled testing while gathering user feedback informing product refinement. This cohort includes musicians, visual artists, designers, content creators, and other digital workers representative of the target demographic, providing diverse use case validation across creative disciplines.

Bank of Ghana sandbox testing period running through December 2025 will evaluate platform performance against regulatory benchmarks, with successful pilot results enabling transition from sandbox to permanent licensing framework, allowing general market launch. Minister George’s commitment to assessing system performance with other key stakeholders before integration recommendations signals the government treating regulatory approval as outcome-dependent rather than predetermined.

User experience optimization during pilot addresses onboarding friction, transaction flow improvements, customer support capacity building, and educational content development, helping creators understand blockchain technology benefits without requiring technical expertise. Manon Dave’s design leadership ensures iterative refinement maintains accessibility principles rather than adding complexity through feature creep common in fintech products.

Early adopter testimonials and case studies documenting real-world impact, including payment speed improvements, fee savings, and income increases, will provide social proof, attracting broader creator adoption post-launch while demonstrating value to regulators and potential investors. Vyrusky’s music marketing example illustrates a storytelling approach, making abstract benefits concrete through creator narratives.

Phase 2: Ghana Market Expansion and Ecosystem Development (2026)

Successful regulatory approval, enabling full commercial launch in December 2025 or early 2026, transitions Akuna Wallet from a limited pilot to general availability for any Ghanaian meeting standard customer identification requirements. This expansion includes marketing campaigns, partnership development with local content creation communities, and integration with Ghanaian mobile money systems, enabling seamless cedi conversion.

Akuna Studios’ establishment, providing professional content production facilities, addresses infrastructure gaps, complementing payment solutions, creating a comprehensive ecosystem where creators access both production tools and monetization pathways in an integrated environment. Studio locations in Accra and potentially secondary cities like Kumasi provide geographic distribution, reducing barriers to physical infrastructure access.

Akuna Pods co-working spaces for creator collaboration, skills development, and community building further develop the ecosystem beyond transaction utility toward a holistic support structure addressing multiple challenges creators face. These physical spaces host workshops, equipment libraries, and networking events, building social capital critical for creative sector success, as youth participation research highlights.

Partnership development with Ghanaian financial institutions, mobile network operators, and technology companies expands distribution channels and value-added services, potentially including micro-lending for equipment purchases, insurance products protecting creator income, and business advisory services helping creators formalize operations and scale. These partnerships leverage existing customer relationships and physical distribution networks that Akuna Group lacks as a startup operation.

Phase 3: Regional Expansion and Pan-African Ambition (2027+)

Regional expansion, beginning with West African countries facing similar creative economy challenges and sharing regulatory commonalities through the ECOWAS economic integration framework, provides a logical growth path after Ghana market validation. Nigeria, Senegal, the Ivory Coast, and other regional markets represent populations totaling 400+ million, with substantial creative sectors currently undermonetized due to payment barriers.

East African expansion, potentially including Kenya, Tanzania (where the Zanzibar studio project establishes Elba’s presence), Uganda, and Rwanda (already demonstrating fintech policy leadership through the Bank of Ghana passporting initiative), addresses markets with different linguistic, cultural, and regulatory contexts requiring product adaptation. Tanzania’s selection is particularly strategic, given Elba’s existing relationship with President Hassan and studio construction commitment, creating synergies between infrastructure initiatives.

Southern African markets, including South Africa, Zimbabwe, and Zambia, present opportunities in regions with more developed financial infrastructure but similar creator economy payment challenges, requiring different value propositions emphasizing cost savings and international payment access rather than basic banking inclusion. South Africa’s relatively developed creative sector, contributing 3% of GDP, suggests substantial market potential for premium services beyond basic payment functionality.

Continental scale ambition, eventually encompassing all African countries where meaningful creator economies exist, requires sustained execution, regulatory navigation across diverse jurisdictions, and capital access supporting multi-market operations. Idris Elba’s vision of establishing the “African Odeon” cinema chain and comprehensive creative economy infrastructure demands a decade-plus commitment and hundreds of millions in investment beyond the current Akuna Wallet scope.

Conclusion: Blueprint for Bridging Africa’s Digital Economy Divide

Idris Elba’s Akuna wallet Ghana launch with government and Stellar partnership represents more than a celebrity cryptocurrency venture or niche fintech product; it establishes a blueprint for systematically addressing payment infrastructure gaps, excluding African creators from $470 billion global creative economy, despite producing content consumed by worldwide audiences. The Three-Layer Solution Architecture, combining Stellar blockchain settlement, virtual US bank account bridge, and Bank of Ghana regulatory integration, demonstrates how progressive policy, proven technology, and celebrity advocacy converge to solve problems that government or market forces individually cannot address.

Success in transforming Ghana’s 60% unbanked youth population into globally-connected content creators monetizing imagination through seamless international payment infrastructure would validate the approach, potentially replicable across African countries sharing similar challenges. The $18 billion African creator economy opportunity by 2030 becomes achievable when payment barriers dissolve and production infrastructure investments, including Akuna Studios and cinema chains, materialize alongside financial technology solutions.

However, execution risks remain substantial. Regulatory approval uncertainty, user adoption challenges among target demographics skeptical of blockchain technology following cryptocurrency scams, competition from established payment platforms potentially entering African markets, and capital requirements, scaling infrastructure across diverse markets with varying regulatory frameworks all threaten initiative sustainability. Elba’s personal credibility and Ghanaian heritage provide authenticity and trust-building blocks, but cannot substitute for operational excellence and sustained capital investment required for continental-scale impact.

The broader implications extend beyond Akuna Wallet’s commercial success to demonstrate whether Africa can build digital economy infrastructure, capturing a proportional share of global opportunities, versus remaining permanently dependent on developed-market platforms extracting value without reciprocal investment in local capacity. Ghana’s regulatory innovation through the fintech sandbox and Minister George’s policy leadership position the country as a potential regional hub attracting investment and talent, generating competitive advantages beyond the creative economy to encompass broader financial services and technology sectors.

For creators, the promise remains straightforward: transform imagination into income through removing payment barriers that have historically prevented African creative potential from accessing global markets and receiving fair compensation for work consumed by worldwide audiences. Whether Akuna Wallet fulfills this promise at scale or remains a niche solution serving early adopters depends on execution quality in the months ahead as the pilot transitions to full launch and expansion planning advances. The opportunity is clear, the technology proven, the regulatory framework supportive; what remains is delivering product experience and ecosystem support, justifying creator trust and sustained engagement.

iMali delivers independent payment systems analysis, fintech research, and market intelligence for payment professionals, financial institutions, and technology leaders. Our comprehensive coverage examines payment innovation, regulatory developments, and market trends shaping the global digital economy. From blockchain payment solutions to digital wallet platforms, iMali provides the research and insights driving informed decisions in the rapidly evolving payments landscape.

Nice, so Elba is doing great things in Africa, let me try out the Akuna Wallet.