Yellow Card retires retail crypto app effective January 1, 2026, marking a significant shift in the cryptocurrency landscape as one of the continent’s leading crypto platforms abandons individual users to focus exclusively on institutional clients, leaving millions of retail customers scrambling to find alternatives before the December 31, 2025, withdrawal deadline. This strategic pivot signals a broader industry trend where crypto companies increasingly prioritize high-margin B2B services over retail users, fundamentally reshaping how individuals access digital assets in emerging markets.

This comprehensive guide provides everything Yellow Card users need to know about the shutdown, including step-by-step withdrawal instructions, a detailed comparison of 10+ alternative platforms, strategic migration frameworks, and an analysis of why this pivot matters for the future of retail crypto access globally.

Understanding Yellow Card’s Retail App Shutdown: Timeline and Key Facts

Yellow Card’s announcement on October 29, 2025, caught millions of users off guard, with the company framing the decision as a “strategic refocus” toward institutional-grade stablecoin infrastructure rather than a retreat from consumer markets. The shutdown timeline creates urgent deadlines that all current users must understand to protect their funds and maintain crypto access.

Critical Dates Every User Must Know

The withdrawal window operates on strict deadlines with no extensions. October 29, 2025, marked the official announcement date with immediate withdrawal availability for all users. December 31, 2025, represents the final day to withdraw funds directly through the Yellow Card mobile app with normal processing. January 1, 2026, brings a permanent app shutdown, making all direct withdrawals impossible, forcing users into a web-based claims process that Yellow Card describes as “secure” but provides limited details about.

Users maintaining zero balances received separate notices on November 1, informing them of immediate account deactivation the following day. Accounts with positive balances remain active through December 31 but transition to locked status January 1, requiring identity verification and proof of ownership for any future fund recovery.

What Happens to Your Funds After January 1, 2026

Yellow Card emphasizes funds will not be lost after the deadline, promising regulatory-compliant secure storage with later recovery options. However, the company provides minimal specifics about this post-shutdown claims process, including expected processing times, required documentation, potential fees, or accessibility for users in different jurisdictions. This ambiguity creates significant risk for users who miss the December 31 deadline, potentially facing weeks or months of delays accessing their own money.

The company states personal data will be retained only as legally required before deletion or anonymization, though specific retention periods and deletion procedures remain unclear. Users concerned about data privacy should request explicit information about their data handling before the shutdown.

Why Yellow Card Chose B2B Over Retail

The Yellow Card justifies the pivot through three primary arguments. First, enterprise demand increased “drastically” according to Chief Marketing Officer John Colson, with over 30,000 businesses now using the platform versus approximately one million retail users at peak. The business-to-client revenue model offers superior economics: institutional clients transact larger volumes more predictably with lower customer acquisition costs compared to retail users requiring constant marketing and support.

Second, the competitive retail landscape grew increasingly challenging with platforms like Binance, Luno, and numerous regional players offering lower fees and wider cryptocurrency selection. Yellow Card’s limited coin offering, approximately 12 cryptocurrencies versus 350+ on Binance, struggled to compete while closed-marketplace peer-to-peer trading couldn’t match open P2P platforms for liquidity and pricing.

Third, regulatory complexity in retail operations across 34 countries created compliance costs and operational friction that B2B clients can better absorb. Institutional clients typically handle their own regulatory obligations while providing Yellow Card with larger, more stable revenue streams.

The Broader Industry Trend of Retail Users Left Behind

Yellow Card’s decision mirrors accelerating industry patterns where African crypto platforms pivot toward B2B services, abandoning retail users. Competitors, including Quidax and Busha, increasingly emphasize business payment rails over consumer trading. This consolidation leaves retail users with fewer options precisely when cryptocurrency adoption growth creates the highest demand for accessible on-ramps.

The trend reflects venture capital pressure for crypto startups to demonstrate sustainable revenue models after years of user acquisition subsidies. B2B infrastructure offers clearer paths to profitability through recurring enterprise contracts versus retail trading, generating income through volatile transaction volumes. Publishers celebrating Yellow Card’s $88 million funding and partnership with Visa, processing $3 billion in 2024 transactions, overlook how these successes depend entirely on institutional rather than retail activity.

The Complete Withdrawal Guide and Protecting Your Funds Before December 31, 2025

Immediate action protects both funds and options. Delays risk technical issues near the deadline when support teams face overwhelming volume from millions of users simultaneously withdrawing. The systematic withdrawal process ensures maximum fund recovery while establishing alternative platform access before the Yellow Card shutdown.

Step 1: Verify Your Account Status and KYC Tier

Before initiating any withdrawals, confirm your current account standing through the Yellow Card app Account Settings section. Users on Tier 0 must complete Tier 1 KYC verification before withdrawing fiat or cryptocurrency, requiring valid government-issued identification, proof of address, and selfie verification photograph. The verification process typically completes within 24-48 hours, though increased volume near the deadline may extend processing times.

Check for any account restrictions or limitations that could prevent withdrawals. Users with locked accounts due to previous security flags must contact Yellow Card support immediately to resolve issues before the deadline. Restricted accounts require additional verification, potentially including video calls or supplementary documentation.

Step 2: Document All Holdings and Transaction History

Create comprehensive records of all Yellow Card holdings before withdrawing funds. Screenshot or export full transaction history showing all deposits, trades, and current balances. Document cryptocurrency wallet addresses used for deposits to Yellow Card and fiat bank accounts used for withdrawals. Save all tax-relevant information, as some jurisdictions require transaction history for cryptocurrency tax reporting.

Verify balance accuracy by comparing app-displayed amounts against blockchain records for cryptocurrency holdings and bank statements for fiat deposits. Discrepancies should be reported to support immediately, as dispute resolution after shutdown becomes significantly more difficult.

Step 3: Choose Strategic Withdrawal Method Based on Asset Type

Cryptocurrency withdrawals offer the fastest processing and maximum flexibility. For holdings in Bitcoin, Ethereum, USDT, USDC, or other supported cryptocurrencies, withdraw directly to external wallet addresses you control rather than converting to fiat first. This approach preserves cryptocurrency positions while avoiding foreign exchange spreads and withdrawal fees that fiat conversions incur.

Ensure destination wallet addresses support the specific cryptocurrency and network (BTC vs BTC Lightning, ETH vs Polygon, etc.), as sending to incompatible addresses causes permanent loss. Small test transactions verify address accuracy before withdrawing full balances.

Fiat withdrawals suit users preferring immediate local currency access. Select bank transfer or mobile money options based on location and preferences. Processing times vary by payment method and region: bank transfers typically complete within 1-3 business days, mobile money processes within hours to one day, and instant EFT provides same-day settlement in supported markets.

Transaction limits temporarily increased for the shutdown period may still restrict single-withdrawal amounts, requiring multiple transactions to fully empty accounts. Plan accordingly to complete all withdrawals well before the December 31 deadline, allowing time for processing delays or technical issues.

Step 4: Execute Withdrawals with Safety Protocols

Initiate withdrawals during business hours when support teams are available to address any issues. Avoid last-minute December 30-31 withdrawals when platform load peaks and processing delays compound. Stagger multiple withdrawals over several days rather than attempting all on one day, spreading technical risk and ensuring backup options if initial attempts fail.

Monitor withdrawal processing through the app’s Transaction History section, tracking each request’s status. Most withdrawals are completed within stated timeframes, though some experience delays during high-volume periods. Contact support immediately if any withdrawal remains pending beyond the expected processing window.

Verify successful fund receipt in destination accounts before considering withdrawal complete. Cryptocurrency transfers require blockchain confirmations (typically 1-6, depending on asset) before funds are spendable. Fiat transfers require bank or mobile money confirmation.

Step 5: Confirm Zero Balance Before Deadline

After completing all withdrawals, verify zero balances across all asset types through the Yellow Card app Holdings section. Any remaining balance, regardless of amount, requires withdrawal before December 31 to avoid the post-shutdown claims process. Remember that very small amounts may not meet minimum withdrawal thresholds, potentially creating account lockout situations after the deadline.

Screenshot final zero-balance confirmation as proof of complete withdrawal in case any future disputes arise. Retain all transaction confirmations, blockchain records, and correspondence with Yellow Card for tax purposes and potential future reference.

The Alternative Platform Comparison Matrix of 10+ Replacements Ranked

Selecting appropriate Yellow Card alternatives requires evaluating multiple factors beyond simple cryptocurrency buying and selling. Platforms differ dramatically in cryptocurrency selection, fee structures, payment methods, user experience, security measures, regulatory compliance, customer support quality, and regional availability. Strategic platform selection matches individual needs against platform strengths rather than defaulting to the largest or most advertised options.

Tier 1: Enterprise-Grade Platforms (Best for Active Traders)

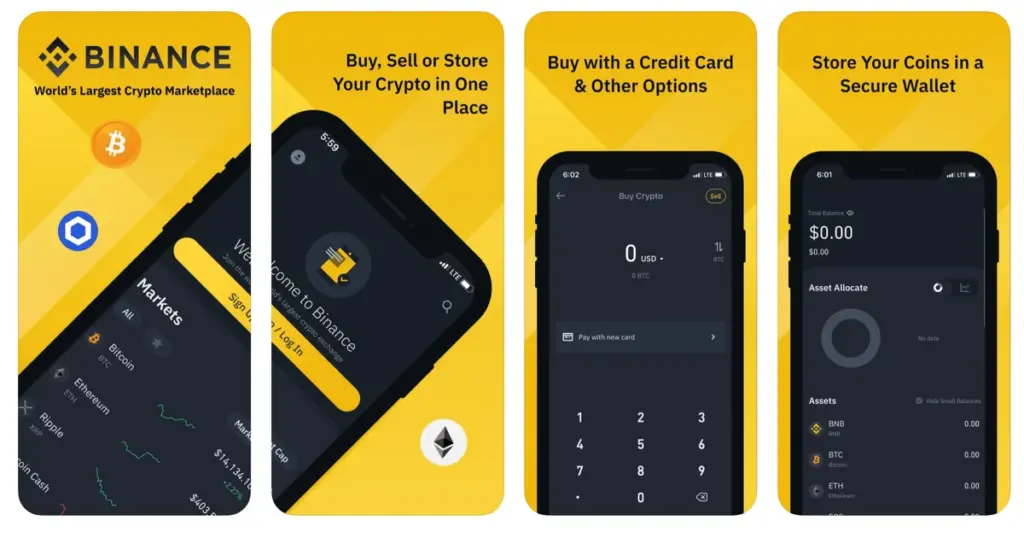

Binance dominates global cryptocurrency exchange markets with 350+ supported cryptocurrencies, advanced trading tools including futures and options, industry-leading liquidity ensuring tight spreads, and peer-to-peer marketplace enabling direct fiat-to-crypto trades with local payment methods, including mobile money for some locations. The P2P platform specifically serves former Yellow Card users through negotiable exchange rates and broad payment method support, including bank transfers, mobile money, and digital wallets.

Binance’s advantages include the widest cryptocurrency selection among all alternatives, competitive trading fees starting at 0.1% and reducing with volume, robust security including multi-factor authentication and cold storage, and comprehensive educational resources for new users. Disadvantages center on complexity overwhelming beginners, occasional customer support delays during high-volume periods, and regulatory uncertainties in some jurisdictions, creating deposit/withdrawal restrictions.

Best suited for experienced traders comfortable with advanced interfaces who prioritize cryptocurrency variety and trading features over simplicity. New users should start with small amounts while learning the platform before committing significant funds.

Bybit focuses on derivatives trading alongside spot markets, offering futures contracts, options, and leveraged trading unavailable on most alternatives. The platform supports 100+ cryptocurrencies with particular strength in newer altcoins and DeFi tokens. Bybit’s tiered fee structure rewards high-volume traders while remaining competitive for occasional users.

Advantages include professional trading tools rivaling desktop platforms, strong liquidity in major trading pairs, and innovative trading features like grid bots and copy trading. Disadvantages involve steep learning curves for beginners, limited fiat on-ramp options compared to P2P-focused platforms, and higher minimum deposits than beginner-friendly alternatives.

Best for sophisticated traders seeking advanced features and willing to invest time mastering complex tools.

Tier 2: User-Friendly Platforms (Best for Beginners and Casual Users)

Breet positions itself as the premier Yellow Card alternative for Nigerian users through over-the-counter crypto-to-cash conversions, emphasizing speed and simplicity. The platform supports major cryptocurrencies, including Bitcoin, Ethereum, USDT, and USDC, with instant settlement and competitive exchange rates. Breet’s crypto-to-crypto swapping feature enables portfolio rebalancing without fiat conversion.

Key advantages include the fastest Naira withdrawals among Nigerian platforms, zero fees on crypto sales, transparent pricing, a beginner-friendly interface requiring minimal cryptocurrency knowledge, and responsive customer support addressing issues quickly. Primary limitations involve Nigeria-focused service limiting international user access, smaller cryptocurrency selection than Binance or Bybit, and a lack of advanced trading features for experienced users.

Ideal for former Yellow Card users in Nigeria, prioritizing ease of use and fast local currency access over trading features.

Roqqu serves Nigerian and Ghanaian users through cryptocurrency buying and selling with Naira, extending functionality to airtime top-ups, bill payments, and NFT support, differentiating from pure crypto exchanges. The platform handles major cryptocurrencies plus selected altcoins with emphasis on practical utility rather than maximum variety.

Advantages include a multi-purpose financial app integrating crypto with everyday services, fast Naira withdrawals comparable to Breet, and active social media support channels providing quick assistance. Disadvantages encompass occasional app stability issues during high usage, customer support inconsistency during peak periods, and limited cryptocurrency education resources compared to larger platforms.

Best suited for users wanting cryptocurrency access alongside traditional financial services in a single app.

Busha targets Nigerian cryptocurrency newcomers through a sleek mobile-first design emphasizing visual appeal and ease of navigation. The platform recently transitioned from an in-app agent sales model to automated bank settlement, significantly improving withdrawal speed. Cryptocurrency selection remains limited, focusing on established coins rather than an extensive altcoin variety.

Key advantages include an exceptionally user-friendly interface, lowering entry barriers, zero withdrawal fees for Nigerian users, eliminating common friction points, and low trading fees, creating a cost-effective on-ramp for new users. Limitations center on restricted cryptocurrency selection, frustrating users seeking specific altcoins, a Nigeria-focused service limiting international applicability, and a basic feature set lacking advanced trading tools.

Ideal for absolute beginners making their first cryptocurrency purchases who value simplicity over comprehensive features.

Tier 3: Specialized Platforms (Best for Specific Use Cases)

Luno emphasizes security and regulatory compliance, making it the preferred choice for risk-averse users and institutional participants. The South African-based platform operates across multiple African countries with a strong focus on educational content and beginner support. Cryptocurrency selection remains conservative, focusing on well-established coins with proven track records.

Advantages include robust security measures, including cold storage and insurance, regulatory compliance, providing peace of mind for cautious users, strong educational resources helping beginners understand cryptocurrency fundamentals, and reliable customer support with responsive resolution times. Disadvantages involve higher fees than competitors, a limited cryptocurrency selection that frustrates advanced users, and slower platform evolution compared to more agile startups.

Best suited for security-conscious users prioritizing regulatory compliance and educational support over lowest fees or widest cryptocurrency selection.

Bitmama provides peer-to-peer cryptocurrency trading focused on African markets with emphasis on local payment method support. The platform facilitates direct buyer-seller matching with escrow services, protecting both parties during transactions. Cryptocurrency variety spans major coins plus selected altcoins with particular strength in stablecoins.

Key advantages include flexible payment methods supporting local preferences, competitive rates through peer-to-peer matching, an integrated wallet for secure storage, and a pan-African focus serving multiple markets beyond Nigeria. Limitations encompass variable liquidity depending on active traders, longer transaction times than instant-settlement platforms, and a learning curve for P2P trading mechanics unfamiliar to exchange users.

Ideal for users valuing payment flexibility and competitive rates, willing to accept slightly longer transaction times.

Obiex serves Ghanaian and Nigerian markets through a straightforward buy-sell interface with emphasis on zero-fee trading. The platform supports 15+ cryptocurrencies, including major coins and selected altcoins, plus fiat representations like Ghana Cedis and Nigerian Naira. Instant cryptocurrency swapping within the platform enables portfolio management without external exchanges.

Advantages include zero trading fees, creating a cost advantage over competitors, instant coin swaps within seconds, a straightforward interface minimizing confusion, and support for both Ghanaian and Nigerian markets. Disadvantages involve a smaller user base than major platforms, affecting liquidity, limited cryptocurrency variety compared to Binance, and a basic feature set lacking advanced trading tools.

Best for users in Ghana or Nigeria seeking zero-fee trading with a straightforward interface.

Accrue positions as a comprehensive Yellow Card replacement, emphasizing multi-functionality beyond pure cryptocurrency trading. The platform enables cryptocurrency buying and selling plus cross-border payments, savings accounts earning up to 7% annual interest, US bank account access, virtual dollar cards for online purchases, airtime and gift card purchases, and free instant peer-to-peer transfers.

Key advantages include the broadest feature set among alternatives, transforming the app into a financial hub, US bank account access, opening international payment options, high savings interest rates exceeding traditional banks, and strong security with regulatory compliance. Limitations center on newer platforms with less established track records, potential feature complexity overwhelming simple-needs users, and limited cryptocurrency variety focused on major coins.

Ideal for users seeking a comprehensive financial platform combining cryptocurrency with traditional banking services.

Tier 4: Global Giants (Best for International Users)

Coinbase serves the global market through a regulated exchange licensed in over 100 countries, with particular strength in North American and European markets. The platform supports 100+ cryptocurrencies with institutional-grade security and comprehensive insurance protecting user funds. Coinbase emphasizes regulatory compliance, making it a preferred option for users prioritizing legitimacy and accountability.

Advantages include the strongest regulatory standing among major exchanges, institutional-grade security with comprehensive insurance, a user-friendly interface bridging the gap between beginner and advanced users, and extensive educational resources, including earn-while-learning programs. Disadvantages involve higher fees than competitors, limited availability in some African countries, and customer support challenges during high-volume periods.

Best suited for users prioritizing regulatory compliance and willing to pay premium fees for peace of mind.

Gate.io provides comprehensive cryptocurrency trading with 1,400+ supported coins representing the widest selection among mainstream exchanges. The platform emphasizes early access to new tokens and DeFi projects, attracting users seeking high-risk, high-reward opportunities. Advanced trading features include margin trading, futures, and innovative products like startup token launches.

Key advantages include unmatched cryptocurrency variety, early access to emerging projects, competitive trading fees, and advanced trading tools for sophisticated users. Limitations encompass an overwhelming interface for beginners, a higher risk profile from less-established coin listings, and variable liquidity in smaller altcoin pairs.

Ideal for experienced cryptocurrency enthusiasts seeking maximum variety and early project access.

The Strategic Migration Framework

Successful platform migration requires a systematic approach, avoiding common pitfalls that create security vulnerabilities, tax complications, or fund access issues. The strategic framework addresses technical requirements, security considerations, and long-term platform optimization.

Step 1: Multi-Platform Diversification Strategy

Avoid single-platform dependency by establishing accounts on 2-3 complementary platforms serving different needs. Primary platform handles the majority of trading activity based on the lowest fees, the widest cryptocurrency selection, or the best user experience matching individual preferences. Secondary platform provides backup access, ensuring cryptocurrency liquidity if the primary platform experiences technical issues, regulatory challenges, or security incidents.

Specialized platform addresses specific needs unmet by primary options: peer-to-peer trading for payment flexibility, savings accounts for yield generation, or international platforms for global cryptocurrency access. This diversification mirrors traditional finance’s multi-bank approach, spreading risk while optimizing features across platforms.

Step 2: Security-First Account Setup

Prioritize security during initial account creation, establishing maximum protection before funding accounts. Enable two-factor authentication immediately using authenticator apps like Google Authenticator or Authy, rather than SMS-based verification vulnerable to SIM-swap attacks. Create unique, complex passwords for each platform using password managers to prevent credential reuse across services.

Verify official platform URLs and app stores before downloading, avoiding phishing sites mimicking legitimate platforms. Bookmark verified URLs and only access platforms through saved bookmarks rather than search engines, which return potentially spoofed sites. Download apps exclusively from the official Apple App Store or Google Play Store, verifying developer names match official platform publishers.

Complete Know Your Customer verification immediately, even if not required for initial deposits, as unverified accounts face withdrawal restrictions during crisis periods. Verification typically requires government-issued identification, proof of address, and a selfie photograph, which can be completed within 24-48 hours for most platforms.

Step 3: Gradual Fund Migration with Testing

Begin with small test transactions verifying platform functionality before committing significant funds. Deposit minimum amounts (typically $10-50 equivalent), testing the complete cycle of deposit, potential trade, and withdrawal, confirming platform performance meets expectations. This approach identifies technical issues, clarifies the user interface, and verifies customer support responsiveness before major fund commitment.

Gradually increase deposit amounts as confidence builds, spreading risk across the migration timeline. Large single deposits create vulnerability if technical issues or account restrictions prevent withdrawal. Staged migration allows course correction if the chosen platform proves unsuitable.

Monitor initial transactions closely, including deposit confirmations, trade executions at expected prices, and withdrawal processing within stated timeframes. Any irregularities merit immediate investigation through customer support before additional fund transfers.

Step 4: Feature Optimization and Cost Minimization

Leverage platform-specific features to maximize value beyond basic buying and selling. Staking programs offer cryptocurrency yield ranging from 3-15% annually, depending on coin and platform. Savings accounts provide a fiat yield up to 7% significantly exceeding traditional bank rates. Trading fee reductions through volume tiers or platform token holdings lower ongoing costs for active users.

Referral programs generate bonuses for both referrer and referred users, creating an acquisition incentive. Educational programs, including Coinbase Earn, provide free cryptocurrency while learning about blockchain technology. These value-adds distinguish otherwise-similar platforms, justifying strategic platform selection beyond basic functionality.

Step 5: Long-Term Relationship Management

Maintain awareness of platform evolution, including new features, fee structure changes, regulatory developments, and security incidents affecting user funds. Follow the official platform social media and subscribe to email notifications, ensuring awareness of critical updates.

Periodically reassess platform choice as the cryptocurrency landscape evolves rapidly. Emerging platforms may offer superior features, lower fees, or better regional support, justifying migration despite initial switching costs. Established platforms may deteriorate through increased fees, reduced cryptocurrency support, or regulatory challenges necessitating alternative evaluation.

Understanding the B2B Pivot: What Yellow Card’s Decision Means for Retail Crypto

Yellow Card’s institutional focus signals broader cryptocurrency industry maturation away from retail speculation toward enterprise utility. This transition fundamentally reshapes individual cryptocurrency access, creating both challenges and opportunities for retail users.

The Economics of Retail Abandonment

Cryptocurrency platforms face inherent profitability challenges in retail markets. Customer acquisition costs for retail users average $100-300 per user through marketing, onboarding support, and promotional incentives. Individual users generate transaction fee revenue of $20-200 annually, depending on trading frequency. This economic equation becomes sustainable only at a massive scale, requiring millions of active users to achieve profitability.

Conversely, enterprise clients generate substantially higher revenue per customer through larger transaction volumes, recurring service contracts, and premium pricing for institutional-grade infrastructure. Yellow Card’s 30,000 business clients processing $3 billion in 2024 transactions demonstrate this model’s viability compared to one million retail users generating comparatively modest revenue. The pivot decision becomes economically rational even if strategically questionable from a financial inclusion perspective.

The Regulatory Compliance Calculus

Retail cryptocurrency operations face escalating regulatory burden across global jurisdictions, requiring extensive compliance infrastructure. Know Your Customer verification, Anti-Money Laundering monitoring, transaction reporting, capital reserve requirements, and ongoing regulatory audits create substantial operational costs. These compliance obligations scale multiplicatively with retail user count, while business clients better absorb compliance costs through internal processes.

Yellow Card’s operations span 34 countries compound regulatory complexity requiring compliance with divergent frameworks simultaneously. The institutional pivot enables selective market focus, concentrating on jurisdictions with clear regulatory pathways while avoiding regulatory uncertainty characterizing many retail crypto markets.

The Technology Infrastructure Implications

Retail platforms require consumer-grade mobile apps, 24/7 customer support for basic queries, extensive educational content for cryptocurrency beginners, fraud prevention systems protecting against individual bad actors, and high-availability infrastructure handling unpredictable traffic spikes. These requirements create engineering complexity and an ongoing maintenance burden.

Institutional infrastructure emphasizes different priorities, including API reliability for programmatic access, high-volume transaction processing, sophisticated treasury management tools, and white-label solutions enabling enterprise branding. This focus allows specialized development, eliminating consumer-facing features’ resource requirements.

What This Means for the Future of Retail Crypto Access

Yellow Card’s decision likely foreshadows similar pivots from other African cryptocurrency platforms facing identical economic and regulatory pressures. The consolidation leaves retail users dependent on increasingly concentrated platform options, potentially reducing competition and increasing fees.

However, market gaps create opportunities for new platforms purpose-built for retail users rather than attempting hybrid retail-institutional models. Platforms like Breet and Accrue, specifically targeting retail needs abandoned by institutional-focused platforms, may capture displaced Yellow Card users, building sustainable retail-first businesses.

The bifurcation between retail and institutional cryptocurrency infrastructure mirrors traditional finance’s separation between consumer banking and investment banking services. This specialization may ultimately benefit users through platforms that optimize specifically for retail needs rather than splitting focus between incompatible customer segments.

Conclusion: Taking Control of Your Cryptocurrency Future

Yellow Card retires retail crypto app, marking a significant inflection point for individual cryptocurrency users requiring immediate action before the December 31, 2025, withdrawal deadline and strategic long-term planning for sustainable cryptocurrency access beyond Yellow Card. The comprehensive alternatives landscape spanning global giants like Binance and Coinbase, regional specialists like Breet and Roqqu, and innovative platforms like Accrue ensures continued cryptocurrency access for displaced users despite Yellow Card’s institutional pivot.

Successful transition depends on immediate withdrawal completion, protecting funds from post-shutdown claims process uncertainty, strategic alternative platform selection matching individual needs against platform strengths, security-first account setup establishing maximum protection from the start, diversified platform approach spreading risk across multiple services, and ongoing awareness of cryptocurrency landscape evolution informing future platform decisions.

The broader industry trend toward institutional focus creates short-term disruption but may ultimately strengthen retail cryptocurrency infrastructure through specialized platforms purpose-built for individual users rather than attempting hybrid retail-institutional models, creating inherent conflicts. Retail users benefit from this specialization through platforms that optimize specifically for ease of use, customer support, and accessible on-ramps rather than splitting resources between incompatible customer segments.

Take action today, withdrawing Yellow Card funds while reviewing alternative platforms, ensuring seamless cryptocurrency access continuation. The December 31 deadline approaches rapidly, and post-shutdown fund recovery creates unnecessary complexity and delay. Your cryptocurrency future depends on decisions made now. Choose wisely and act decisively, protecting both assets and access.

iMali provides payment intelligence, market analysis, and strategic guidance for individuals and businesses navigating the evolving digital finance landscape. Our comprehensive coverage of cryptocurrency platforms, payment innovations, and financial technology developments empowers readers to make informed decisions about digital asset access, cross-border payments, and emerging financial solutions. Whether you’re transitioning between cryptocurrency platforms, evaluating payment infrastructure, or exploring new financial technologies, iMali delivers the insights and analysis you need for success in the modern digital economy.

Thanks now switched to Binance I never knew it had mobile money purchase and withdrawal.